what is the inheritance tax rate in virginia

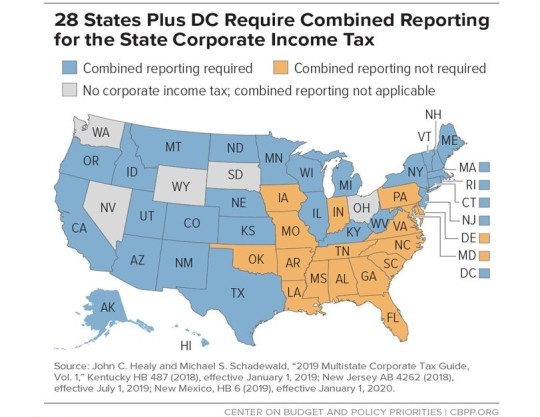

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation States With No.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

However certain remainder interests are still subject to the inheritance tax.

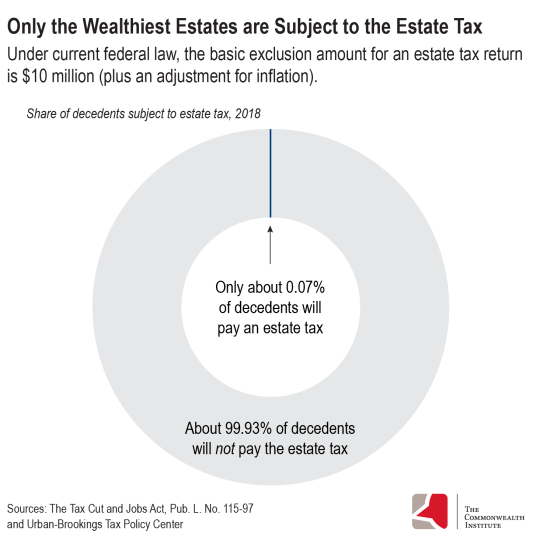

. Estate tax of 10 percent to 20 percent on estates above 55 million. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Estate tax is the amount thats taken out of someones estate upon their death.

The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1 million according to an. Estate tax of 08 percent to 16 percent on estates above 4 million. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

What is the inheritance tax rate in virginia Sunday February 27 2022 Edit. This fact often becomes an unpleasant. The top estate tax rate is 16 percent exemption threshold.

And married couples may each claim the exemption. The state in which your brother lived allows a 10000 exemption for siblings. The state of Virginia requires you to pay taxes if youre a resident or nonresident that receives income from a Virginia source.

If the tax rate for a 40000. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2022 Connecticut estate taxes will range from 116 to 12. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias. You can learn more about how the Virginia income tax compares to. In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale that varies from 18 to 40.

A tax rate of 08 applies on amounts of at least 40000 but less than 90000 and tax rates increase sequentially from. The state income tax rates range from 2 to. There is no federal inheritance tax.

By 2010 Congress raised that exemption threshold to 5000000 and as of 2017 the threshold rose to 5490000. So the taxable income amount of the inheritance would be 40000. Inheritances that fall below these exemption amounts arent subject to the tax.

One both or neither could be a factor when someone dies. Today Virginia no longer has an estate tax or inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

State Tax Proposals Would Make Virginia S Tax System More Fair The Commonwealth Institute The Commonwealth Institute

Virginia Estate Tax Everything You Need To Know Smartasset

Estate Planning Law Firm In Virginia Beach Midgett Preti Olansen Pc

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Retired Residents Of West Virginia Senior Care Marketing Solution Digital Marketing Agency

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

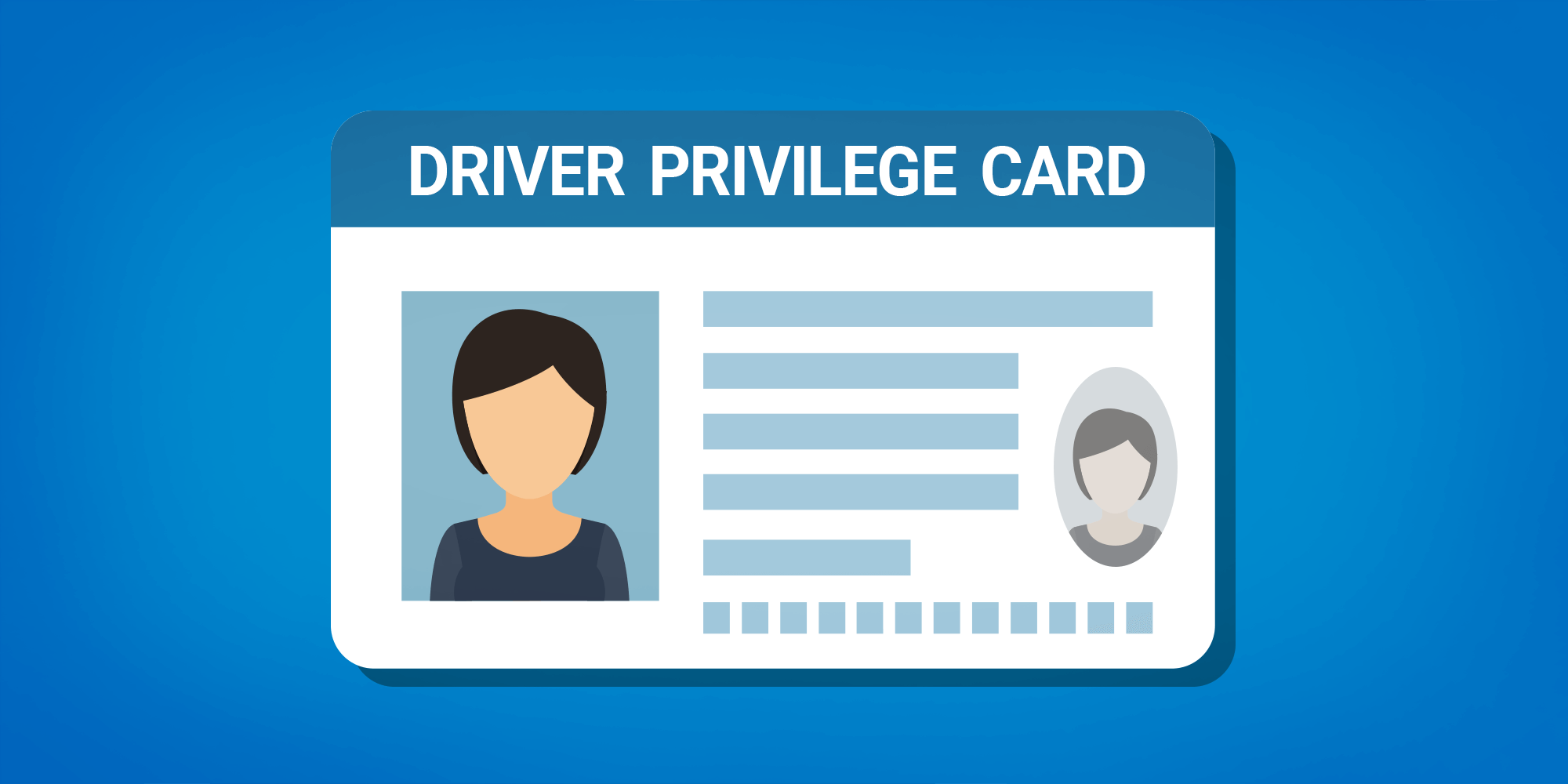

New Driver Privilege Card Virginia Tax

What To Do When You Inherit A House Complete Guide To Selling Fast

Virginia State Taxes Everything You Need To Know Gobankingrates

State Tax Proposals Would Make Virginia S Tax System More Fair The Commonwealth Institute The Commonwealth Institute

West Virginia Estate Tax Everything You Need To Know Smartasset

Selling Inherited Property In Virginia 2022 How To Guide

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

The Differences Between Va Md And Dc Taxation Lipsey Associates

Virginia Inheritance Laws What You Should Know Smartasset

Inheritance Virginia How New Laws May Impact The Your Divorce Planning Argent Bridge Advisors